Ask for Receipt BIR: Complete Guide to NIRI, Templates, Rules & Penalties

Transparency in business transactions is a cornerstone of the Philippine tax system. For decades, the familiar orange “Ask for Receipt” sign reminded consumers to demand official documentation. Today, that system has evolved into a more modern framework under the Bureau of Internal Revenue (BIR).

If you’re a business owner, freelancer, online seller, or professional in the Philippines, this guide explains everything you need to know about:

- Ask for Receipt BIR rules

- The new Notice to Issue Receipt/Invoice (NIRI)

- Templates and display requirements

- Tax mapping penalties

- Compliance under the Ease of Paying Taxes Act

Table of Contents

Ask for Receipt BIR: What It Means Today

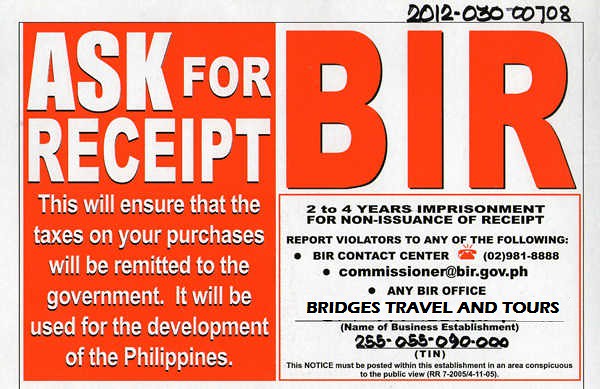

The ask for receipt BIR policy originated under Revenue Regulations No. 04-2000 and was later standardized by RR No. 07-2005. Businesses were required to display the orange “Ask for Receipt” Notice (ARN) to encourage consumers to request official receipts.

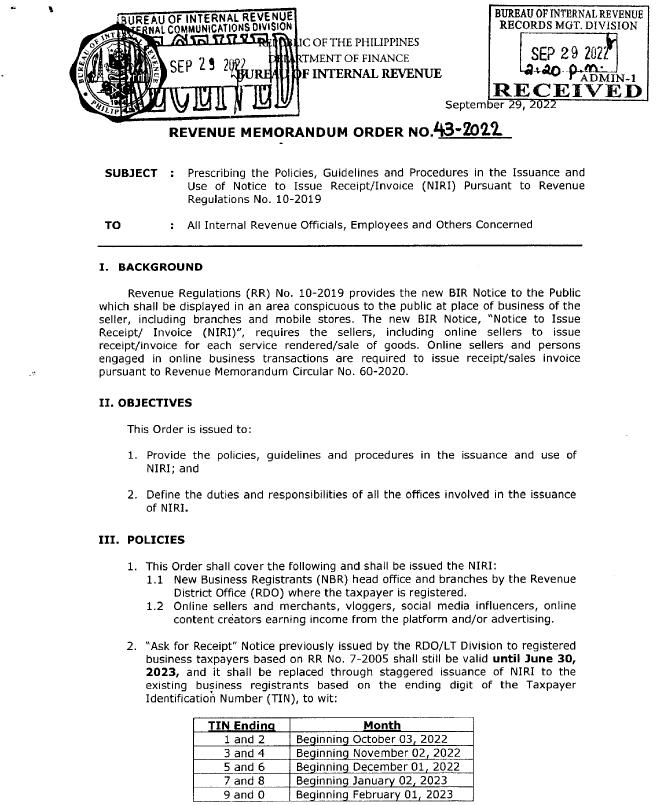

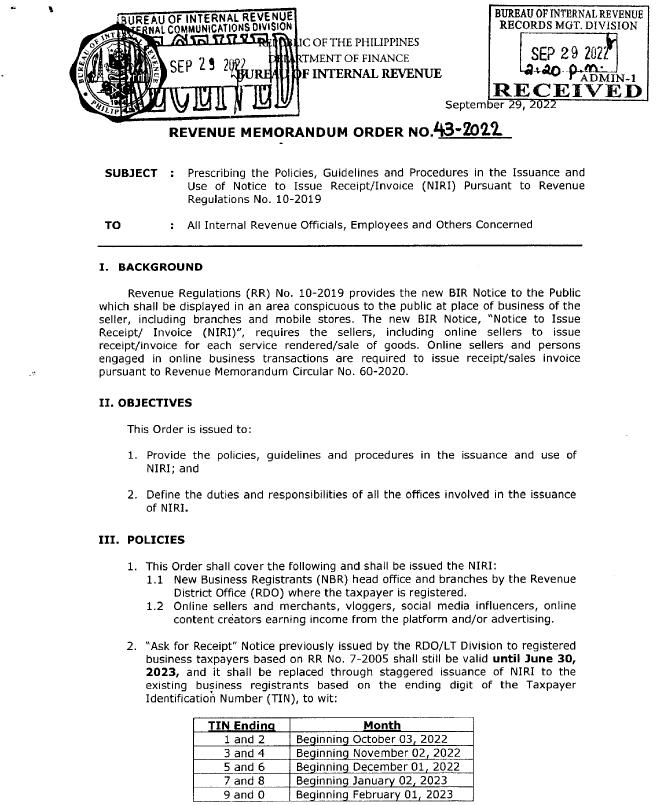

However, under Revenue Regulations No. 10-2019 and Revenue Memorandum Order No. 43-2022, the old orange sign was replaced by the green:

Notice to Issue Receipt/Invoice (NIRI)

The transition officially ended on September 30, 2023. All businesses must now display the green NIRI.

Key Differences: Old vs. New System

| Feature | Old Ask for Receipt Notice | New NIRI |

|---|---|---|

| Color | Orange | Green |

| Information | Generic reminder | Contains business name, address & TIN |

| Scope | Mostly physical stores | Includes online sellers & digital businesses |

| Validity | Expired Sept 30, 2023 | Currently valid |

The NIRI strengthens compliance by including taxpayer-specific details and digital reporting channels.

BIR Ask for Receipt: Legal Basis and Updated Rules

When people search for “bir ask for receipt”, they usually want to know:

- Is it still required?

- Where should it be posted?

- What happens if I don’t display it?

Under RR No. 10-2019 and RMO No. 43-2022:

✔ All registered businesses must display the green NIRI

✔ It must be BIR-issued (no photocopies allowed)

✔ It must be visible at the point of sale

✔ Online businesses must display it digitally

Revenue officers verify this during Tax Compliance Verification Drives (Tax Mapping).

Failure to display the NIRI results in a ₱1,000 administrative fine.

Ask for Receipt: Why It Still Matters Today

Even though the signage changed, the principle remains:

Consumers must always be issued an Invoice for every sale.

Under Republic Act No. 11976 or the Ease of Paying Taxes (EOPT) Act, effective January 22, 2024:

- The distinction between Sales Invoice (SI) and Official Receipt (OR) has been removed.

- All sales (goods and services) must now be evidenced by an Invoice.

- VAT reporting is now accrual-based for everyone.

Updated Invoice Threshold

- Mandatory issuance threshold increased from ₱100 to ₱500

- BUT if a customer requests an invoice, it must be issued regardless of amount.

This strengthens the purpose of the “Ask for Receipt” campaign — empowering consumers to demand proper documentation.

Ask for Receipt BIR Template (Old vs. New NIRI Format)

Many business owners search for an ask for receipt BIR template. However, important reminder:

The NIRI must be issued by the BIR. You cannot create your own version.

What the Official NIRI Contains:

- “ASK FOR A RECEIPT” in bold letters

- Business Name

- Registered Address

- TIN

- Reporting channels (eComplaint, chatbot Revie)

- Legal warning on non-issuance

Old Orange Ask for Receipt Notice (Legacy)

New Green Notice to Issue Receipt/Invoice (NIRI)

If you need the official version, request it from your Revenue District Office (RDO) after updating your registration.

Ask for Receipt Notice: Proper Placement Requirements

The ask for receipt notice must be “conspicuously displayed.”

Here are the updated placement rules:

| Business Type | Placement Requirement |

|---|---|

| Single-counter store | Near cash register |

| Multi-counter store | At every cashier station |

| Online seller | On website or social media page |

| Professional office | Reception/payment area |

| Mobile stall | Visible at transaction point |

During tax mapping, BIR officers check:

- NIRI signage

- Certificate of Registration (Form 2303)

- Authority to Print (ATP)

- Books of Accounts

- CRM/POS stickers

Penalties for Non-Compliance

Failure to follow invoicing rules can lead to serious penalties:

| Violation | Penalty |

|---|---|

| No NIRI displayed | ₱1,000 |

| Failure to issue invoice | ₱10,000 (1st offense) |

| Refusal to issue invoice | ₱25,000 (1st offense) |

| Use of unregistered receipts | ₱10,000–₱20,000 |

| Failure to register business | ₱5,000–₱20,000 + possible imprisonment |

Repeat or serious violations may result in:

- Criminal charges under Section 264 of the Tax Code

- Business closure under Oplan Kandado

Official Email Requirement Under NIRI

One of the biggest changes under RMO 43-2022:

All business taxpayers must designate an official company email address.

To update:

- File BIR Form 1905

- Or update through ORUS

The BIR will use this email to serve:

- Notices

- Audit letters

- Assessment orders

- Compliance reminders

Missing an email notice may mean missing a legal deadline.

Digital Reporting: How Customers Can Report Violations

The NIRI encourages public reporting through:

- eComplaint NO OR (non-issuance of invoice)

- eComplaint RATE (tax evasion)

- eComplaint OTHERS (missing signage)

- Chatbot Revie

Reports are acknowledged within 24 hours, with action within 72 hours.

This makes the “Ask for Receipt” campaign a public accountability tool.

Future Outlook: Electronic Invoicing System (EIS)

The BIR is rolling out the Electronic Invoicing System (EIS).

Target:

All VAT-registered taxpayers integrated by December 31, 2026.

Under EIS:

- Invoices will be digitally generated

- Reported to BIR in near real-time

- Traditional manual receipts may eventually disappear

The green NIRI is considered a transitional step toward full digital compliance.

Final Compliance Checklist for Business Owners

To stay compliant:

✔ Display the green NIRI at every point of sale

✔ Issue an Invoice for every transaction

✔ Convert old Official Receipts properly (if applicable)

✔ Update your official company email

✔ Train staff to always issue invoices

✔ Monitor email for BIR notices

Conclusion

The evolution from the orange Ask for Receipt BIR sign to the green Notice to Issue Receipt/Invoice (NIRI) reflects the Philippine government’s push toward transparency and digital transformation.

For businesses, compliance is no longer optional — it is strategic. Proper invoicing:

- Protects you from penalties

- Builds customer trust

- Ensures VAT claims are valid

- Prevents closure under tax mapping

As the BIR moves toward full electronic invoicing by 2026, businesses that adapt early will have a competitive advantage in a more transparent and digitally connected tax environment.